Mortgage Insurance

Insurance companies determine higher-risk properties or individuals that require a higher-than-average premium based on many factors, including the purchaser’s personal insurance, financial and credit history, property condition, claim history, and other considerations.

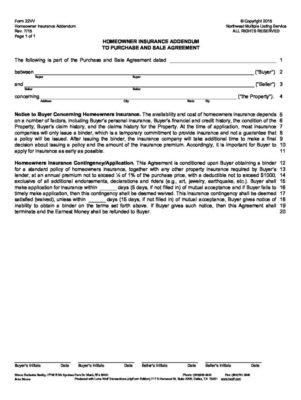

To protect the purchaser from unexpected high insurance costs, all Washington State real estate purchase and sales agreements use an insurance contingency form (Form 22VV), which allows the pending sale to be terminated if insurance costs are deemed excessive.

Homeowner’s insurance is crucial when owning a home as it is a significant cost that protects one of the homeowner’s most valuable assets.

Lenders also require home insurance to protect the asset used as collateral. However, insurance companies may require above-average rates for reasons noted above, which homebuyers may not want to pay. Therefore, realtors in this area add a contingency form that makes homeowner’s insurance cost a contingency.

If the home is tagged as a higher risk and requires a higher premium, the purchaser can terminate the deal.

The contingency form notes that overpriced insurance premiums are above 0.5% of the property’s cost.

Per the form, purchasers have five days to make an application (unless otherwise negotiated) and 15 days (unless otherwise negotiated) to get the insurance quote, review it, and inform the sellers if the property appears to have above-average risk, requiring a higher premium.

Closer Funds and Records Transaction

When funds are received by the closer the property’s Deed of Trust is sent to the county for recording into the buyer’s name. A check is written, or a wire is made to pay off any outstanding loans the seller has on the property.

A check or wire is prepared for the seller as they instructed. Once the property is recorded in the buyers name a call goes out to all parties letting them know that the transaction is completed and that funds, if any, are available to the seller.

In Washington state the seller has until 9:00 PM the day of recording to be out of the property. If the seller is already out the buyer may be able to get keys and assess to the property upon recording.